In January 2008, I began investing in the stock market.

In January 2008, I began investing in the stock market.

I was asked to by my good friend – and fellow LawIsCool contributor – Lawrence Gridin, and I just couldn’t say no.

Except for ECON101 and a couple of books by Sachs and Krugman, I have no education in economics or finance. I understand the principles of supply and demand, elasticity, inflation, and comparative advantage. With enough effort, I can summon and apply these principles to elementary models involving apples and small integers.

But when it comes to the stock market, I tend to gravitate to those anecdotes of dart-throwing monkeys outperforming experienced stockbrokers.

In addition to my lack of training, I am not a gambling man.

I went to a casino for the first time a few months ago. In one night I lost $10 on a 5¢ slot machine. I still rue my loss to that noisy one-armed bandit.

At the time Lawrence asked me to begin investing, I had been following the sub-prime mortgage crisis closely. I am still fascinated by it.

The modern economy can express the folly of myopic greed so beautifully and measurably. A law student might even claim that it does more than reify our sins, but that it also dispenses justice, if it were not for the fact that not only the greedy now suffer.

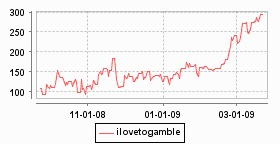

Since January 2008, the stock market has plunged.

The S&P 500 is an index of the prices of five hundred large, publicly-traded companies in the United States. It is considered a bellwether for the American economy. It has fallen from 1468 points to a recent low of 682, or -54%.

So it was that at one of the worst times in history to invest in the stock market, I invested in the stock market.

Believe it or not, I have lost nothing.

More incredibly, ranked against 66,000 avid stock traders — the type who research, trade daily, and actually try to make money off it – I am in the 97th percentile. I beat virtually all of them. What have I gained? Since all that Lawrence asked me to invest was a bit of my time on a popular stock prediction website, I have gained nothing but a better view of the American consumer.

How did I, an uninformed novice, beat the vast majority of enthusiast traders in one of the worst markets ever? I focused on what I did know about the American economy and consumer.

I knew enough about the sub-prime mortgage crisis that it would probably infect the broader credit market. I knew that this would deepen the already existing recession by decreasing consumer spending which, in turn, would generally lower demand in the economy. I thought to myself, what do American consumers nonetheless demand when times are tough, when they’re stressed and unemployed, when property crime is increasing, when their house is foreclosed, and when uncertain political change is fast approaching ?

Answer: guns, drugs, beer, and cigarettes.

So that’s exactly what I invested in. My picks included Sturm, Ruger & Company, Smith & Wesson Holding Corp, Johnson & Johnson, Molson Coors Brewing Company, Anheuser-Busch, Reynolds American, and Altria Group.

It turns out my sardonic hunch was dead on; these companies and their ilk have defied the recession and done incredibly well over the past year, as demand for their products surges.

It turns out my sardonic hunch was dead on; these companies and their ilk have defied the recession and done incredibly well over the past year, as demand for their products surges.

Will I start investing real money in my hunches? Since my conscience prohibits me from lending money to gun and cigarette makers, I’ll have to wait for now…

You can sign up at The Motley Fool – Caps to view my performance and make your own predictions. My username is ilovetogamble.

“If you don’t follow the stock market, you are missing some amazing drama.”

– Mark Cuban, American billionaire